Navigating Economic Waves: The Federal Reserve's Interest Rate Cuts, Real Estate, and Opportunities in 2024

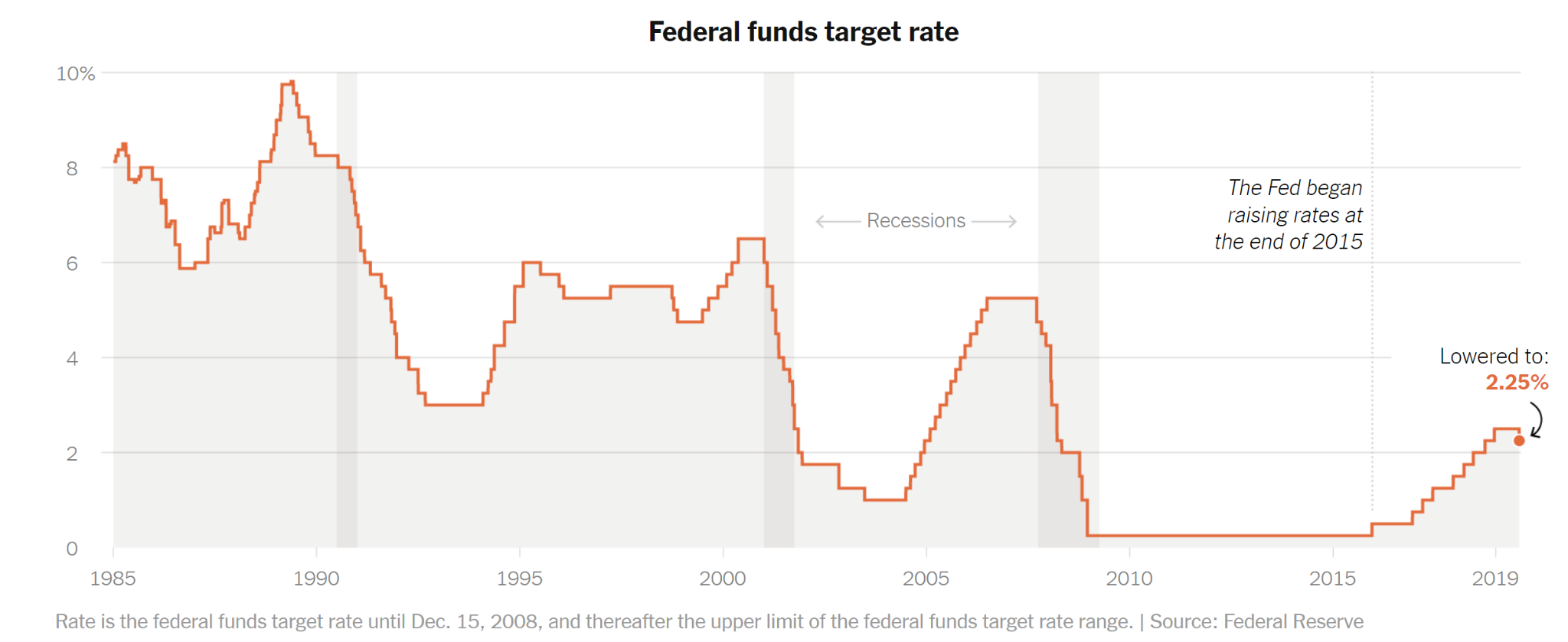

In the ever-changing economy, the Federal Reserve's decisions play a pivotal role in shaping the financial future of individuals, businesses, and entire industries. As we look ahead to 2024, there is growing speculation that the Federal Reserve may cut interest rates up to six times, according to this article from Business Insider. This potential move is fueled by concerns over a slowing economy and aims to stimulate growth. In this blog, we'll explore how these interest rate cuts could impact the real estate market, particularly for homeowners and those involved in architecture-related businesses, and why 2024 might be the opportune time to embark on construction projects.

Interest Rate Cuts and the Real Estate Landscape

When interest rates decline, borrowing becomes more affordable, often leading to increased demand in the real estate market. For homeowners with existing mortgages, this presents an opportunity to refinance at lower rates, potentially reducing monthly payments and freeing up disposable income.

However, the impact extends beyond individual homeowners. Architecture-related businesses, including construction firms and design studios, are likely to experience a surge in demand as more individuals and investors seek to capitalize on favorable financing conditions. Lower interest rates can make large-scale construction projects more financially viable, driving growth in the architecture and construction sectors.

Building Opportunities in 2024

For those contemplating construction projects, 2024 may be an optimal time to break ground. With interest rates anticipated to decrease multiple times throughout the year, the cost of financing construction loans is likely to be more affordable. This could lead to an influx of new developments and infrastructure projects as investors seize the opportunity to capitalize on lower borrowing costs.

Salt Lake City’s Potential to Host the 2034 Olympics

Yet another economic factor to consider is that The Olympic National Committee recently announced that Salt Lake City is a top contender to host the 2034 Winter Olympics. Hosting such a significant event often brings increased attention and economic activity to the region. As the city gears up for the games, there's likely to be heightened demand for housing and accommodations, potentially driving up property values.

Investors and homeowners in Salt Lake City may find themselves in a unique position to leverage the convergence of the Federal Reserve's interest rate cuts and the Olympic games. Those contemplating real estate ventures, whether it be purchasing a home or investing in rental properties, should closely monitor the market dynamics and act strategically.

In the intricate dance between economic policy, real estate, and major events like the Olympics, 2024 promises to be a year of opportunities. The Federal Reserve's potential six interest rate cuts may act as a catalyst, propelling the real estate and architecture-related industries forward. As Salt Lake City takes center stage with the Olympics, the local housing market is poised for potential growth. Whether you're a homeowner, investor, or architect, staying informed and agile in response to these economic shifts will be key to navigating the waves of change in the coming year.